Crypto off-ramps are platforms or services that facilitate the conversion of cryptocurrencies into fiat currencies or other traditional financial assets. They serve as a crucial bridge between the digital asset world and the conventional financial system, allowing users to liquidate their crypto holdings and access cash or bank deposits. This process is essential for individuals and businesses that wish to utilize their cryptocurrency investments in everyday transactions or to reinvest in traditional markets.

Off-ramps can take various forms, including exchanges, payment processors, and ATMs, each offering unique features and benefits. The functionality of crypto off-ramps is not limited to mere conversion; they also play a significant role in enhancing the overall user experience in the cryptocurrency ecosystem. By providing a seamless way to access fiat currency, these platforms help demystify the process of using cryptocurrencies for those who may be hesitant or unfamiliar with digital assets.

As the adoption of cryptocurrencies continues to grow, the demand for efficient and user-friendly off-ramps has become increasingly important, making them a vital component of the broader financial landscape.

Key Takeaways

- Crypto off-ramps are platforms or services that allow users to convert their cryptocurrency into traditional fiat currency.

- Crypto off-ramps are important because they provide a way for cryptocurrency holders to access the value of their digital assets in the real world.

- Crypto off-ramps simplify the conversion process by providing a seamless and user-friendly interface for exchanging cryptocurrency for fiat currency.

- Different types of crypto off-ramps include cryptocurrency exchanges, peer-to-peer platforms, and cryptocurrency debit cards.

- When choosing a crypto off-ramp, it’s important to consider factors such as fees, supported currencies, and security measures.

The Importance of Crypto Off-Ramps

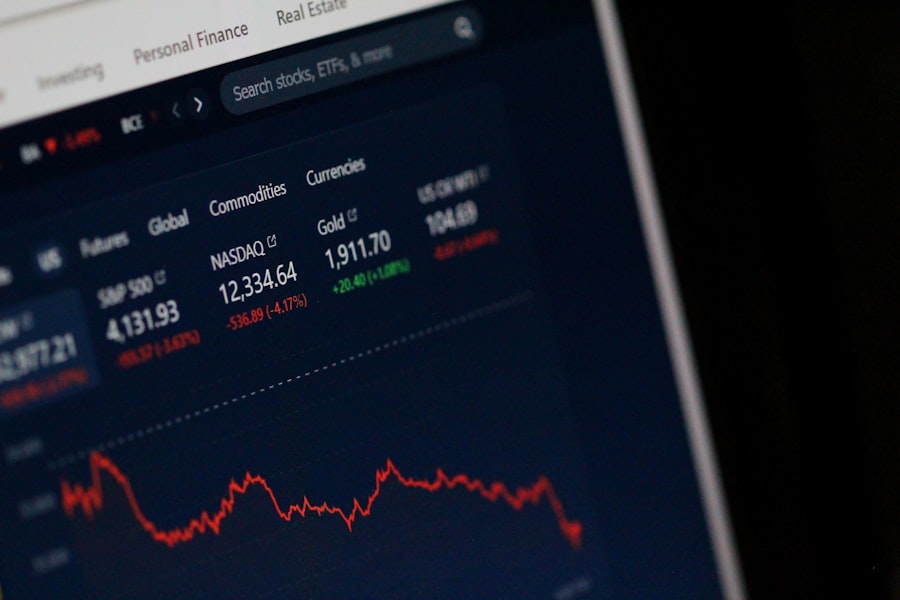

The significance of crypto off-ramps cannot be overstated, particularly as cryptocurrencies gain traction among mainstream users. One of the primary reasons for their importance is the liquidity they provide. Liquidity is essential in any financial market, as it allows investors to enter and exit positions without significantly impacting the asset’s price.

Crypto off-ramps enable users to convert their digital assets into cash quickly, ensuring that they can capitalize on market opportunities or meet urgent financial needs without delay. Moreover, crypto off-ramps contribute to the overall legitimacy of cryptocurrencies as a viable form of currency. By facilitating the conversion of digital assets into fiat currencies, these platforms help bridge the gap between traditional finance and the burgeoning world of cryptocurrencies.

This connection fosters greater acceptance among businesses and consumers alike, encouraging more people to explore and utilize digital currencies in their daily lives. As a result, off-ramps play a pivotal role in driving the mainstream adoption of cryptocurrencies, ultimately contributing to their long-term sustainability and growth.

How Crypto Off-Ramps Simplify the Conversion Process

The conversion process from cryptocurrency to fiat can often seem daunting, especially for newcomers to the space. Crypto off-ramps simplify this process by providing user-friendly interfaces and streamlined procedures that make it easy for individuals to convert their assets. Most platforms offer intuitive dashboards that guide users through each step of the conversion process, from selecting the cryptocurrency they wish to sell to choosing their preferred fiat currency for withdrawal.

This ease of use is particularly important for those who may not have extensive technical knowledge or experience with digital assets. In addition to user-friendly interfaces, many crypto off-ramps also offer instant conversion options, allowing users to complete transactions in real-time. This feature is particularly beneficial in a volatile market where cryptocurrency prices can fluctuate rapidly.

By enabling users to convert their assets quickly, off-ramps help mitigate the risks associated with price volatility, ensuring that individuals can secure favorable rates when liquidating their holdings. Furthermore, many platforms provide various payment methods for withdrawals, including bank transfers, debit cards, and even cash withdrawals at ATMs, further enhancing convenience and accessibility.

Different Types of Crypto Off-Ramps

There are several types of crypto off-ramps available, each catering to different user needs and preferences. One of the most common types is centralized exchanges (CEXs), which allow users to trade cryptocurrencies for fiat currencies or other digital assets. These platforms typically offer a wide range of trading pairs and advanced features such as limit orders and margin trading.

However, users must create accounts and undergo identity verification processes, which can be time-consuming. Another popular type of off-ramp is decentralized exchanges (DEXs), which operate without a central authority. DEXs allow users to trade directly with one another using smart contracts on blockchain networks.

While they offer greater privacy and control over funds, DEXs may not provide direct fiat conversion options, requiring users to first convert their assets into stablecoins before using an off-ramp service. Crypto ATMs represent another form of off-ramp that has gained popularity in recent years. These machines allow users to buy or sell cryptocurrencies for cash in physical locations.

While they offer convenience and anonymity, fees can be higher than those found on online platforms. Additionally, some payment processors have emerged as off-ramps by enabling merchants to accept cryptocurrency payments and convert them into fiat instantly. This option is particularly appealing for businesses looking to integrate cryptocurrencies into their payment systems without dealing with the complexities of direct conversions.

Choosing the Right Crypto Off-Ramp for Your Needs

Selecting the appropriate crypto off-ramp requires careful consideration of several factors tailored to individual needs and circumstances. One critical aspect is the fees associated with using a particular platform. Different off-ramps have varying fee structures, including transaction fees, withdrawal fees, and spreads between buying and selling prices.

Users should compare these costs across multiple platforms to ensure they choose an option that minimizes expenses while maximizing returns. Another important factor is the range of supported cryptocurrencies and fiat currencies. Some off-ramps may only support a limited selection of digital assets or specific fiat currencies, which could restrict users’ ability to convert their holdings effectively.

Additionally, users should consider the platform’s reputation and security measures. Researching user reviews and checking for regulatory compliance can provide valuable insights into a platform’s reliability and trustworthiness.

Security and Compliance Considerations for Crypto Off-Ramps

Protecting User Assets

When dealing with cryptocurrencies, security is of the utmost importance. Given their digital nature, they are susceptible to hacking and fraud, making it crucial for users to prioritize security features when selecting a crypto off-ramp. Reputable platforms implement robust security measures such as two-factor authentication (2FA), cold storage for funds, and regular security audits to protect user assets from potential threats.

Awareness of Phishing Scams and Fraudulent Activities

Users should also be aware of phishing scams and other fraudulent activities that target individuals in the cryptocurrency space. It is essential to be vigilant and take necessary precautions to avoid falling victim to these schemes.

Compliance with Regulatory Standards

Compliance with regulatory standards is another critical consideration for crypto off-ramps. Many jurisdictions require platforms to adhere to anti-money laundering (AML) and know your customer (KYC) regulations to prevent illicit activities. While these measures may involve additional steps for users during account creation or transactions, they ultimately contribute to a safer environment for all participants in the cryptocurrency ecosystem.

Verifying Regulatory Compliance

Users should verify that their chosen off-ramp complies with relevant regulations in their region to ensure a secure and legitimate experience.

The Future of Crypto Off-Ramps

As the cryptocurrency landscape continues to evolve, so too will the role of crypto off-ramps within it. The increasing integration of blockchain technology into traditional financial systems suggests that off-ramps will become more sophisticated and accessible over time. Innovations such as decentralized finance (DeFi) could lead to new types of off-ramps that offer enhanced liquidity options and lower fees by eliminating intermediaries from the conversion process.

Moreover, as regulatory frameworks surrounding cryptocurrencies become more defined globally, we can expect greater standardization among off-ramps regarding compliance measures and security protocols. This evolution will likely foster increased trust among users and encourage wider adoption of cryptocurrencies as legitimate financial instruments. Additionally, advancements in technology may lead to more seamless integration between crypto wallets and off-ramp services, allowing users to convert their assets with minimal friction.

Tips for Using Crypto Off-Ramps Effectively

To maximize the benefits of using crypto off-ramps, users should adopt several best practices that enhance their overall experience. First and foremost, it is advisable to stay informed about market trends and price movements before initiating any conversions. Understanding market conditions can help users time their transactions more effectively, potentially securing better rates when converting their assets.

This knowledge can help them navigate potential challenges more efficiently while ensuring they make informed decisions regarding fees and transaction times. It is also wise to keep track of personal transaction history for tax purposes, as many jurisdictions require reporting on capital gains from cryptocurrency transactions.

Lastly, maintaining strong security practices is essential when using crypto off-ramps. Users should enable two-factor authentication on their accounts, use strong passwords, and be cautious about sharing sensitive information online. By following these tips and remaining vigilant about security measures, individuals can effectively utilize crypto off-ramps while minimizing risks associated with cryptocurrency transactions.

If you are interested in learning more about the world of NFTs and how they are revolutionizing the job market, check out this article on NFT Jobs. This article explores the potential for NFTs to create new opportunities for freelancers and artists, highlighting the growing demand for digital assets in today’s economy. As the popularity of NFTs continues to rise, it is important to understand how these unique tokens can be used to generate income and support the growing digital economy.

FAQs

What are crypto off-ramps?

Crypto off-ramps are services or platforms that allow users to convert their cryptocurrency holdings into fiat currency, such as US dollars or euros. This process is often necessary for individuals or businesses looking to access the value of their cryptocurrency for everyday expenses or investments.

How do crypto off-ramps simplify the conversion to fiat currency?

Crypto off-ramps simplify the conversion to fiat currency by providing a seamless and user-friendly process for exchanging cryptocurrency for traditional money. These platforms often offer competitive exchange rates, low fees, and a variety of withdrawal options, making it easier for users to access the value of their digital assets.

What are the benefits of using crypto off-ramps?

Using crypto off-ramps can provide several benefits, including the ability to easily access the value of cryptocurrency for everyday expenses, investments, or other financial needs. Additionally, these platforms often offer secure and efficient conversion processes, allowing users to quickly and conveniently convert their digital assets into fiat currency.

Are there any risks associated with using crypto off-ramps?

While crypto off-ramps can provide a convenient way to convert cryptocurrency to fiat currency, there are some risks to consider. These may include potential security vulnerabilities, regulatory compliance issues, and the possibility of encountering fraudulent or unreliable platforms. It’s important for users to conduct thorough research and due diligence before using a crypto off-ramp service.

What are some popular crypto off-ramp platforms?

There are several popular crypto off-ramp platforms, including Coinbase, Kraken, Bitstamp, and Gemini. These platforms offer a range of services for converting cryptocurrency to fiat currency, and each has its own unique features, fees, and withdrawal options. Users should carefully compare these platforms to find the one that best meets their needs.